Playing the Silver Hair Card

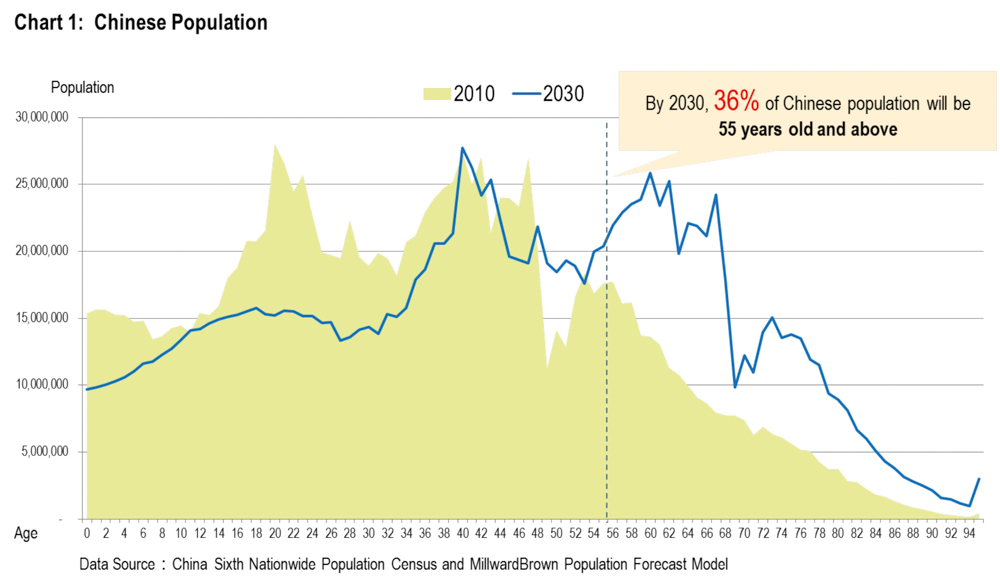

The Chinese population is ageing. According to MillwardBrown’s (华通明略 Huátōng Mínglüè) forecast, 36% of the Chinese population will be 55 years old and above by 2030 (Chart 1). The tipping point for embracing innovations and adaptations for the silver hair segment is upon us. Marketers can either be proactive by rising to the challenges posed by this trend now or be forced to respond by competitive and regulatory pressures later on. What do marketers need to know about the needs and demands of the silver hair consumers? How can they approach this segment by designing age-neutral products and effective communication?

Silver Linings that Come with Age

More Disposable Income

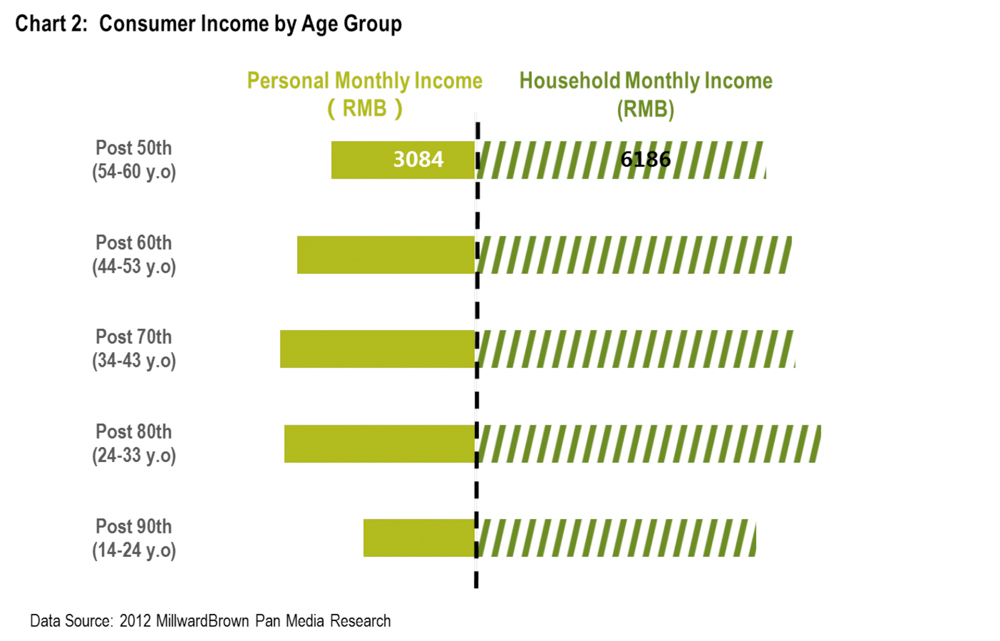

The silver hair segment has monthly personal and household incomes at RMB 3000 and RMB 6000 (€360 and €720) respectively, which are only a RMB1000+ (€120+) shortfall from the earnings of the mainstream segments of the post-70s and -80s (Chart 2). Furthermore, silver hair consumers probably do not have mortgage nor education fees for their children to pay. If they own residential properties, they are likely to increase in value over time. Chinese children are also bound by filial piety and are likely to supplement their parents financially and materially. Hence many silver hair consumers have more money at their disposal than meets the eye.

It is also worth noting that other stakeholders are also buying products for silver hair consumers to use. From Kantar WorldPanel data, 24% of the products used are gifts from others. For example, a great deal of nutritional and health products are marketed as ‘gift products’, especially during festive seasons, and are purchased by the children and friends of silver hair consumers. More and more marketers are starting to realise the power of the gift market for the ageing population in China. Momchilovtsi Milk created by Bright Dairy (光明乳业 Guāngmíng Rǔyè) is a successful product, especially in low-tier markets. The product is positioned around the story of ‘longevity’, tapping into the niche of gifting yoghurt to silver hair consumers.

Willing to Spend and more brand Savvy

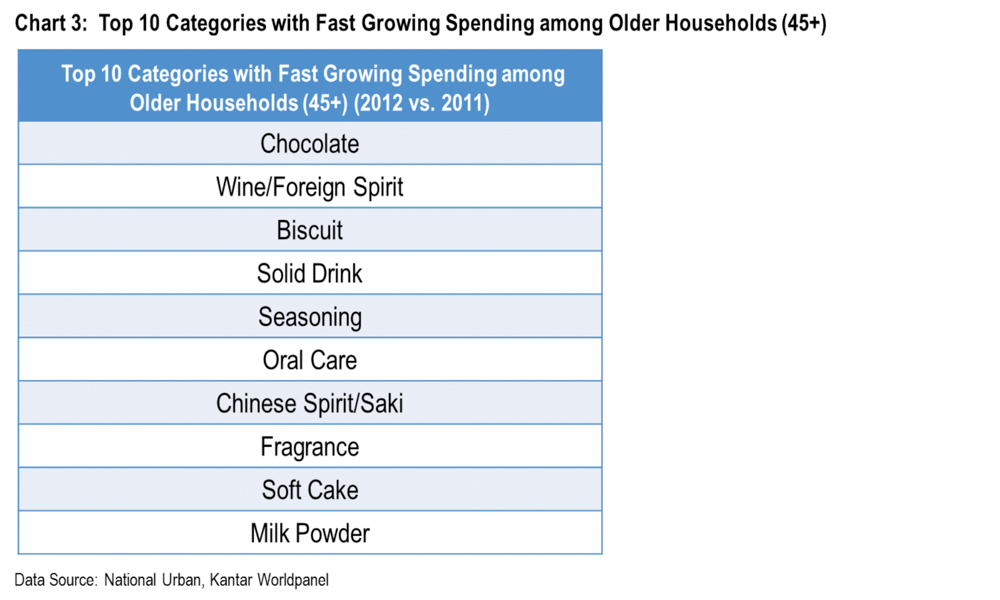

Not only do they have relatively more money in their pockets, today’s silver hair consumers are more into repertoire purchases, meaning that they use a number of brands per category as opposed to being loyal to a single brand. These consumers also spend more and buy the best for their grandchildren. Kantar Worldpanel data show categories, such as chocolate, wine and biscuits are among the fast growing categories for this particular consumer segment (Chart 3).

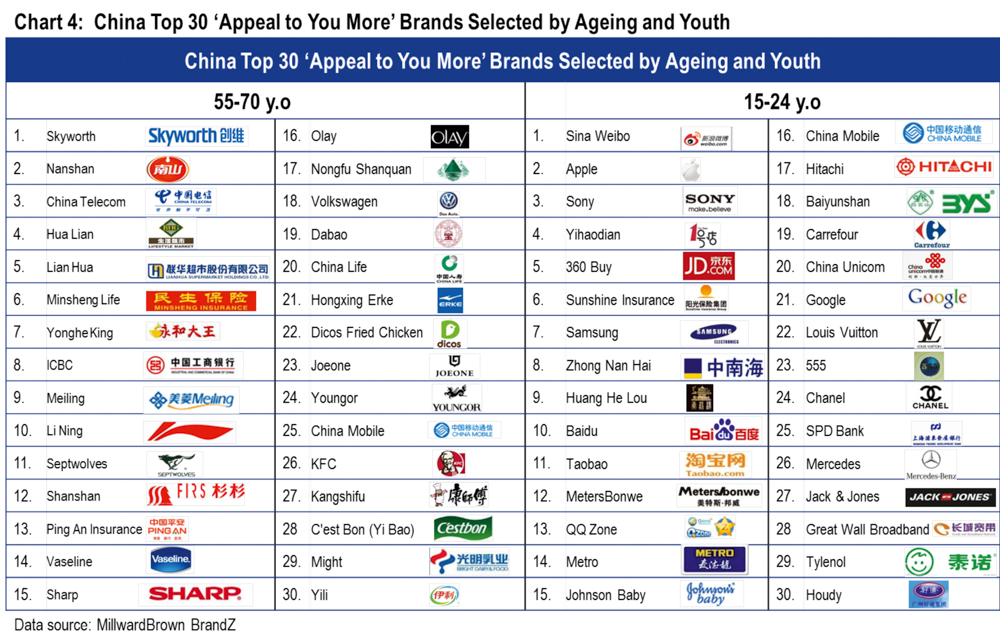

Data from BrandZ also indicate that their knowledge about brands is increasing. However, brands that appeal more to them tend to be different from those that appeal more to the younger generation. Comparing the top 30 ‘Appeal to You More’ brands chosen by consumers aged 55-70 years of age vs. those selected between 15-24, only China Mobile (中国移动 Zhōngguó Yídòng) appeared on both lists. The other 29 brands are different for the two age groups, meaning that the brand overlap rate stands at a mere 3% (Chart 4). Yet there is still hope for bridging the gap because Japan, the nation in the world with the oldest population, has seven brands in the top 30 list that appeal to both young and old. Japan’s brand overlap rate is higher at 23%. If Japan is a good indication for what an ageing China will look like in the future, then as marketers become more silver hair savvy, more brands will start to appeal to a wide age range.

Both BrandZ and Kantar Worldpanel data show a tendency for silver hair consumers to become less price-driven and know more about the brands they purchase.

Out to Pursue and Enjoy life

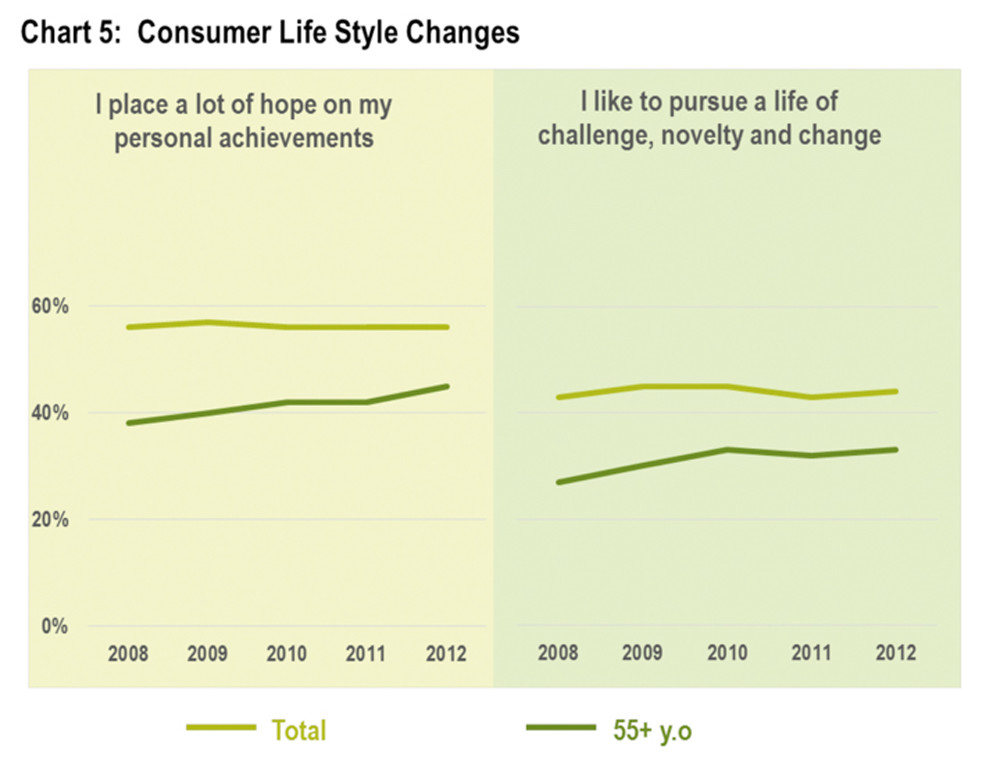

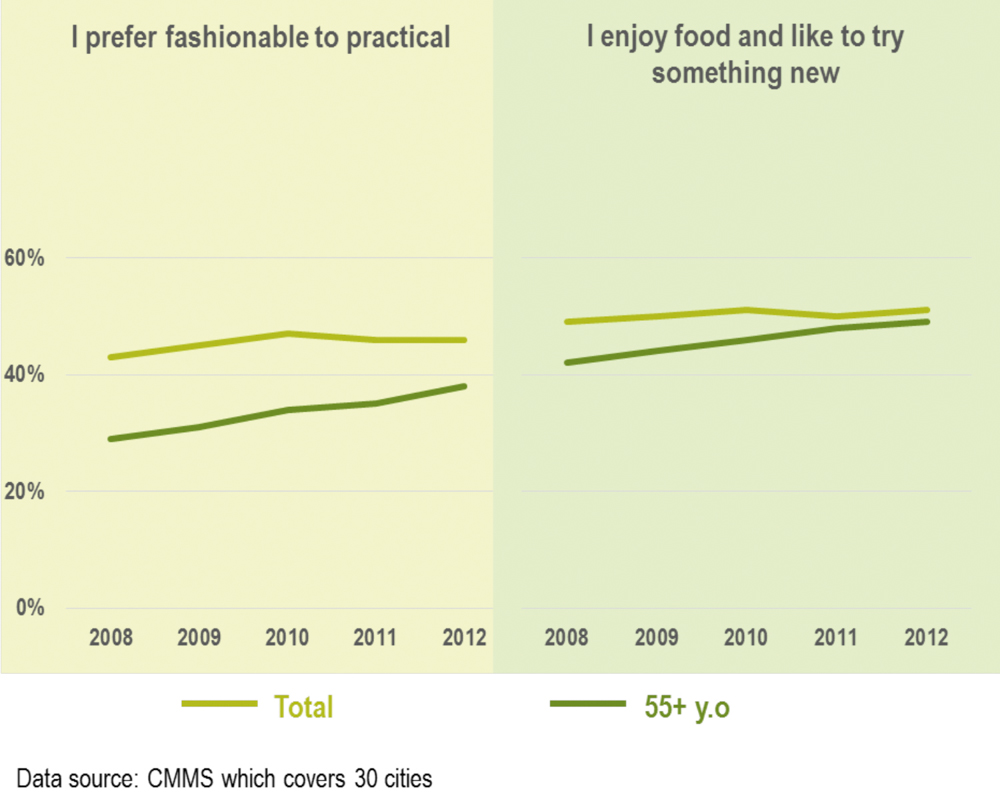

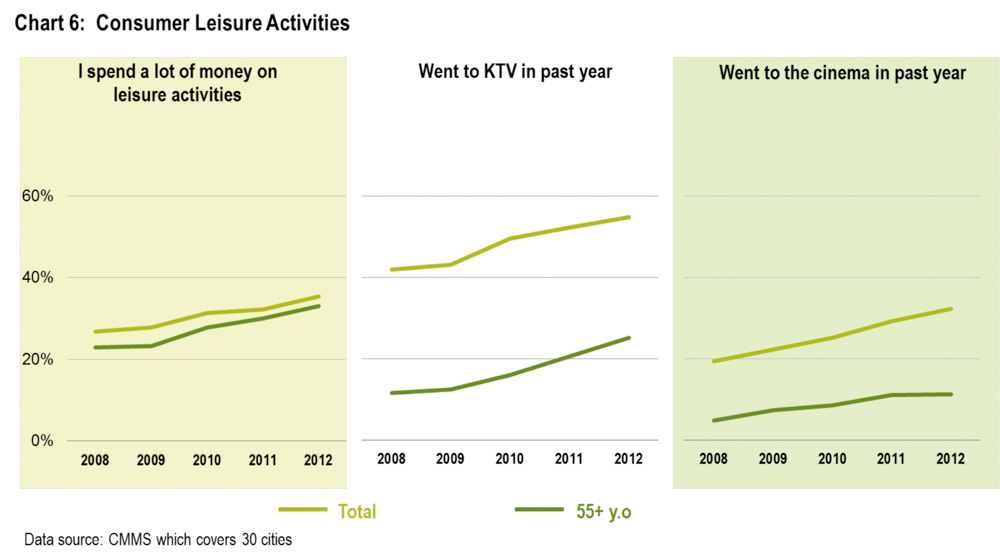

The definition of ‘old’ is also undergoing dynamic transformation. Silver hair consumers no longer want to just wind down, stay home and take life easy. Many are still looking for personal achievements, behaving as if they were in their prime and continuing to pursue their education, work in new careers as well as maintaining a level of overall activity not previously associated with their age segment (Chart 5 and Chart 6).

Zhang Guangzhu (张光柱) and Wang Zhongjin (王钟津) are the ’happy backpackers’, famous on the internet for their global backpacking tour around seven continents and taking in more than 40 countries. As they travel, they update their journey real time on their blog. Prior to the 2012 Olympic Games in London, Yili (伊利) and Youku (优酷) aired micro-movies about the Olympic journeys of common Chinese people and featured the couple in the series. Their story inspires others to believe that people of all ages can live a fulfilling life. Their blissful golden years are now the dreams of many young people.

More Internet and online Shopping- savvy

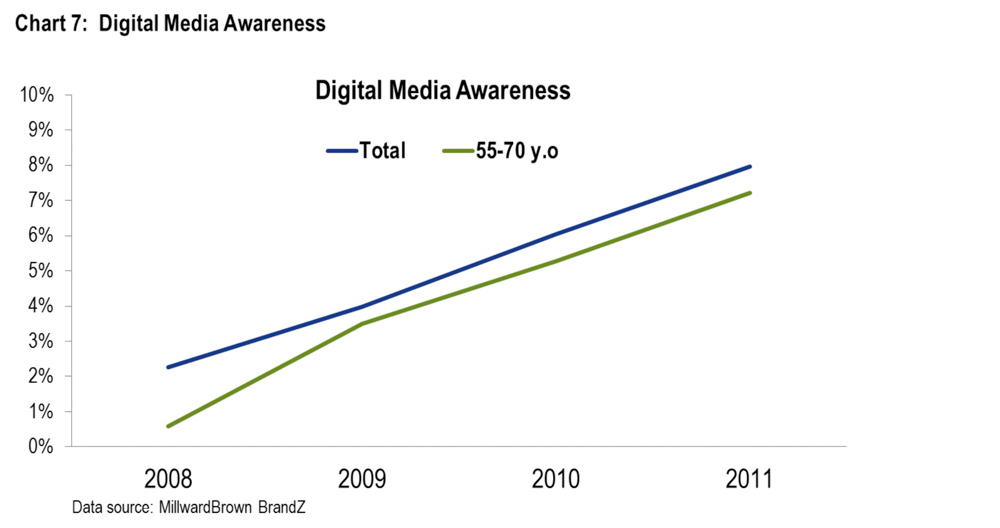

BrandZ research also reveals that 37% of silver hair consumers have accessed the internet over the past week, spending 10.3 hours on average per week. This rate is higher than listening to radio at just 7.1 hours per week. They also show a higher affinity towards online video, mobile ads and cinema ads than mainstream consumers. Despite the strength of traditional media in reaching this target segment, digital media has an important role to play in an integrated marketing communication plan. In fact, the awareness of brands having advertised in the digital media by silver hair consumers has gone from 0.5% in 2008 to 7% in 2011 (Chart 7).

Silver hair consumers also partake in online shopping. Kantar Worldpanel data from actual consumers’ recordings of their FMCG purchases suggest that close to 18% of silver hair families in China bought their groceries online in 2012. This is quite astonishing and probably signals a willingness to explore new channels of shopping and online payment.

Furthermore, Taobao (淘宝) reported that there were 12,000 silver hair consumers who spent an average of RMB 340,000 (€41,000) per year, highlighting the considerable spending power of the silver hair segment. Gone were the days of little money and frugality. During the 2012 ‘double holidays’ of Mid-Autumn Festival (中秋节 Zhōngqiū Jié) and Chinese National Day (国庆节 Guóqìng Jié), tmall.com released a micro-movie called My Father on its official micro-blog. Calling on the young to remember how their fathers once taught them how to ride a bicycle when they

were young, the film encouraged them to reciprocate during the holidays by teaching their fathers how to shop online.

Tackling Silver Hair Consumers

Adopting age Neutral Product Design

Age-neutral means to satisfy the unique needs of silver hair consumers in a way that is natural and beneficial to all ages. One example is a TV remote control with large buttons to meet the easy-to-use needs of silver hair consumers with deteriorating dexterity. This design is beneficial to and welcomed by consumers of all ages.

Ageing of the bodies and minds of silver hair consumers may affect the relevance and use of products and services they have relied upon all their adult lives. Despite these discrepancies, this generation will probably continue using the same products even as they age. It is, therefore, important to make products age neutral, so as to be inclusive of consumers who grow into silver hair status.

The most basic principles of age-neutral are to understand the needs of silver hair consumers and then design products that are simple to use for all. The world is increasingly being designed by younger people for younger people. The current cohort of young marketers are, however, ill-equipped to tackle silver hair consumers and have to be ’retrained’ to be sensitive to the needs of these older consumers. Proactive car companies, such as Ford in the US, explore the physical limitations of older consumers by having their designers wear a ‘third-age suit’, which simulates the experience of stiff joints, thicker mid-section and lesser eyesight. Young marketers also need to understand that silver hair consumers often have needs for services around a product, such as education on how to use a smartphone. Marketers need to know how to explain things in a simple and direct way. They also need to be patient when silver hair consumers operate at a slower pace.

Age-neutral designs should be applied to products that are marketed across and bought by all ages, such as white goods, anti-ageing cosmetics, hair treatments, airline flights, home entertainment, cars, and Fast Moving Consumer Goods (FMCGs), etc. In light of an ageing population, it is a socially responsible and smart response for marketers to make their businesses future-proof. This may involve a culture change in terms of how business is conducted and how products are designed. If and when marketers successfully adopt age-neutral strategies and accommodate the needs of silver hair consumers, chances are, they will improve the product experience of all consumers.

Create a Desirable and Friendly brand Personality

Brand personality is regarded as a set of human characteristics associated with a brand. In the same way that personality is the sum of what a person is all about, brand personality is a catch-all that sums up the essence of a brand. Consumers readily attribute a diversity of personality traits to brands, such as ‘trustworthy’, ‘competent’, ‘agreeable’, ‘rebellious’. Brand personalities are created over time by a wide-ranging marketing mix (product, brand name, advertising, word-of-mouth, CEO image and brand user image, etc). These brand personalities, once built, are relatively distinct and enduring. In a marketplace full of commodity products, brand personality or its nuances can differentiate one brand from the next.

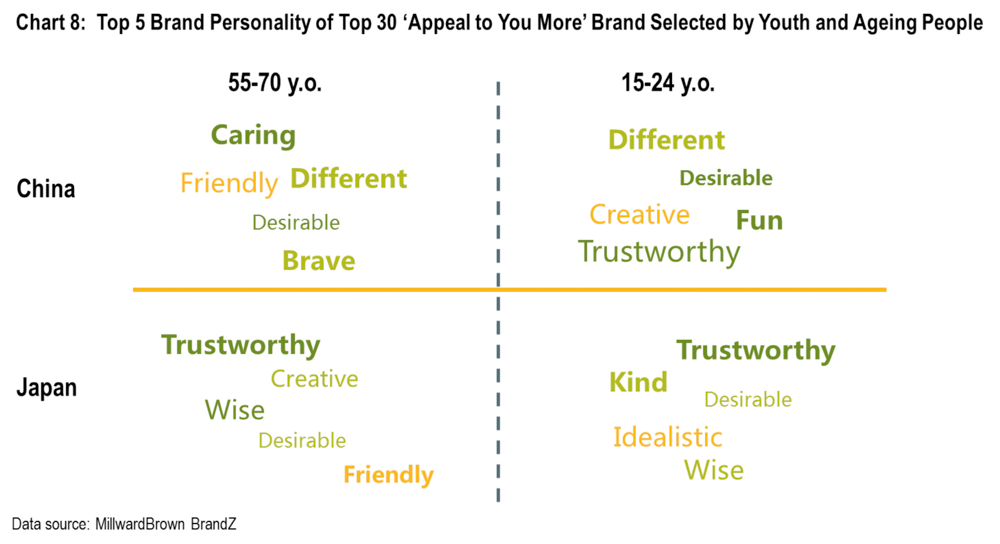

BrandZ data reveal that brands which are ‘different’ and ‘desirable’ can win the hearts of both young and old in the China market. When compared with data from Japan, ‘desirable’ and ‘friendly’ are brand personalities most liked by silver hair consumers in both countries (Chart 8). If these brand personalities are in a brand’s DNA, marketers can highlight them when communicating with silver hair consumers to enhance relevancy.

Take a Positive and light-hearted approach in Communication

By far the biggest and most immediate opportunities lie in tweaking the communication of products that are purchased by all ages, making them relevant to silver hair consumers. MillwardBrown has accumulated a wealth of advertising test data via LINK test and can provide guidance on what creative elements appeal to silver hair consumers.

While silver hair consumers do not want to be patronised because of their old age, they would like their special and addressed. There is no worse way to alienate silver hair consumers than to suggest they should buy old people products. What companies can do is emphasise the positive rather than the negative aspects of ageing, such as focusing on internal beauty instead of external beauty, and highlighting qualities, such as wisdom, elegance, confidence to which silver hair consumers can relate. In terms of content, brands can play on nostalgia,

stories about animals or children, or employ music and taglines with which silver hair consumers are familiar. All these should be done in a simple and direct way, providing added value to the lives of silver hair consumers.

Deploy Effective media Touch Points

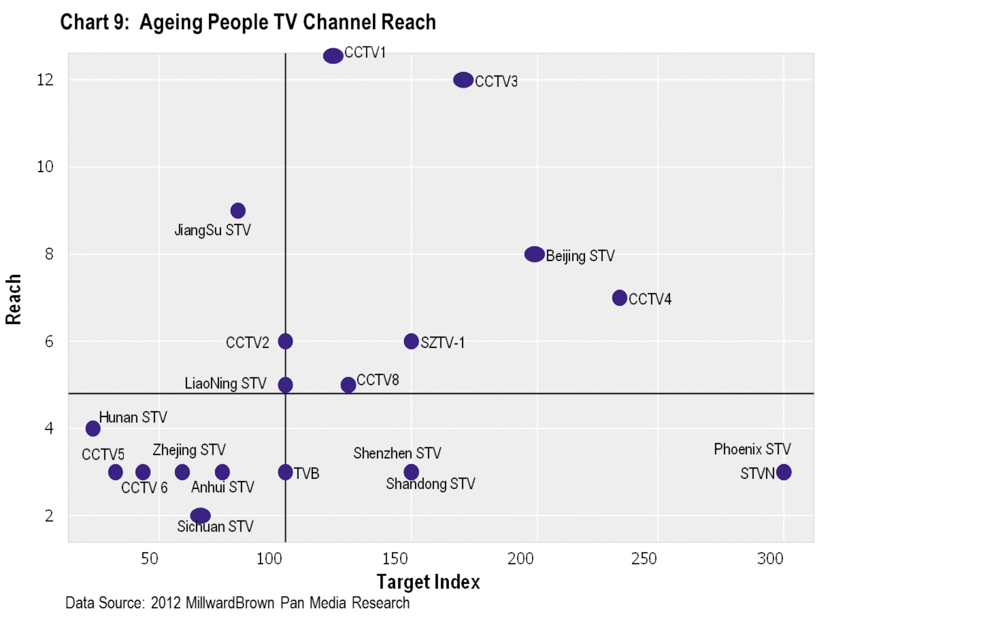

Traditional media, such as TV, newspaper and radio, have high penetration among silver hair consumers’ media usage. They are still the dominant media for reaching this consumer segment. According to MillwardBrown’s 2012 Pan Media study, 93% of silver hair respondents have watched TV in the past week, at an average of 18.2 hours. Rates of reading newspapers and listening to radio are 66% and 41% respectively. In terms of content, they are interested in news, family, lifestyle, health, law and order as well as traditional culture. Channels specialising in these contents, such as CCTV1, CCTV3, CCTV4 and Beijing Satellite TV (北京卫视 Běijīng Wèishì), have both high reach and impact against this segment (Chart 9). Conversely, Hunan Satellite TV (湖南卫视 Húnán Wèishì) and Zhejiang Satellite TV (浙江卫视 Zhèjiāng Wèishì), known for entertainment and variety shows targeted at younger viewers, are less effective for communicating with silver hair consumers.

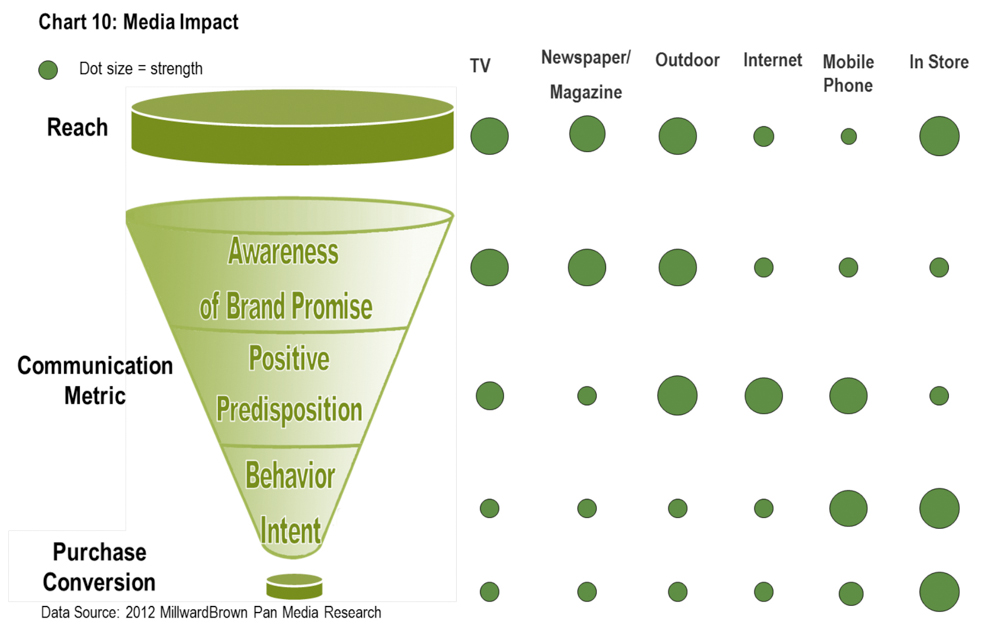

Different media also play different roles in the purchase pathways of silver hair consumers. TV, newspaper and magazines have high penetration and are good for raising brand awareness and spreading brand information. OOH, internet and mobiles are more effective in improving brand preference, while in-store represents the key battleground for converting sales (Chart 10).

Personalise the First moment of Truth

With more silver hair consumers exploring and fast adopting modern trade, e-commerce is becoming a more and more acceptable way of shopping for silver hair consumers. From a channel marketing point of view, it is important to make sure that products are available in these new channels.

It is also important to keep in mind not to alienate silver hair consumers in other channels. Kantar Worldpanel data suggest silver hair consumers still prefer channels with personal interactions (i.e. grocery stores, direct sales and free market) which have built a trusted relationship with silver hair consumers through communication and interactions over the years. So, it is essential for marketers to ensure that products are presented at Point of Sale (PoS) with friendly interactions, such as face-to-face element of conversion in stores, even when the products are sold in self- service format. Direct sales also prove to be an effective way of selling to silver hair consumers, especially in the low tier cities.

To persuade silver hair consumers to purchase particular brands, in-store activation is as critical as advertising itself. Silver hair consumers have relatively more time on their hands and they see visiting stores as a way of having fun. This indicates that marketers need to create more in-store visuals and activation to drive the ‘moment of truth’.

by Sirius Wang, Director, New Solutions, MillwardBrown China

& Jason Yu, General Manager, Kantar Worldpanel China

& Theresa Loo, National Training Director, Ogilvy & Mather, China

Special thanks to Lucia Su, Haze He and Pierre Murata from MillwardBrown for their contributions to this article.

-About MillwardBrown:

www.millwardbrown.com

-About Kantar Worldpanel:

www.kantarworldpanel.com

-About Ogilvy & Mather:

www.ogilvy.com

Share on Facebook

Share on Facebook Share on Twitter

Share on Twitter Share on LinkedIn

Share on LinkedIn