Lecture by Professor Siwei Cheng: China’s Current Economic Situation

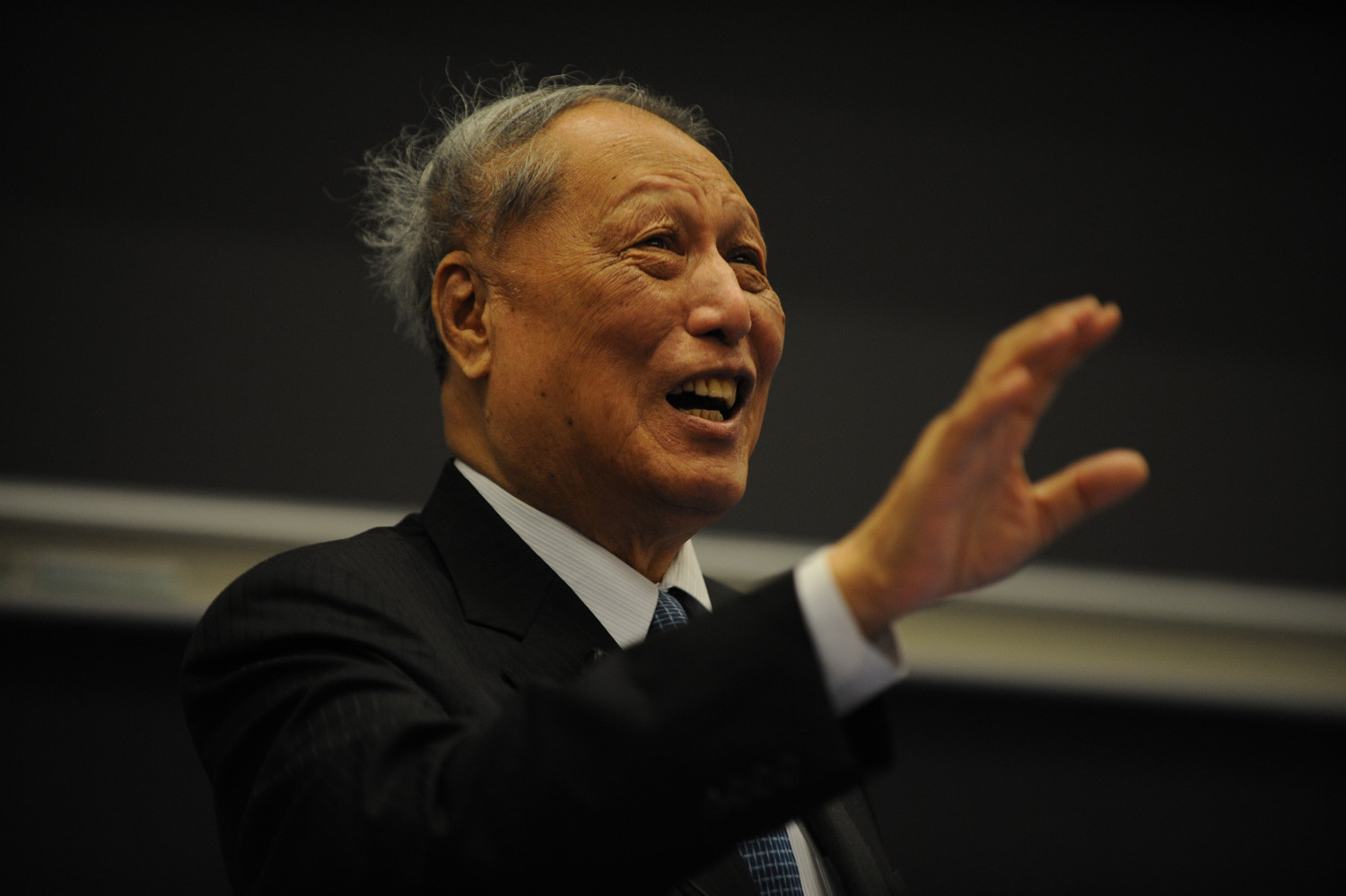

On 24 May 2013, the Faculty of Economics & Business of the University of Groningen and the Groningen Confucius Institute co-organised a lecture by the famous Chinese scholar and statesman Professor Siwei Cheng (成思危). Known in China as the ‘father of venture capital’, Professor Cheng delivered a lecture entitled China’s current economic situation in connection to FDI (foreign direct investment) and venture capital.

International Crisis and Domestic Problems

China’s current economy is demonstrating a drop in growth. According to Professor Cheng the reasons for this economic slow-down are twofold: international and domestic. Internationally, the financial crisis is not yet over. The United States, although slowly improving, is still in economic straits; economic growth in Japan remains sluggish and the European debt crisis still continues to be a big problem. To illustrate the huge effects of the international economic crisis, he pointed out that, last year, the world economy grew 3.2% and this is the first time that economic growth in emerging and developing countries is higher than growth in the developed world.

Professor Cheng expects that the world economy might improve a little this year, and provided a prognosis for economic growth of around 3.5%. He anticipates that international trade will improve a little this year, but not too much because the demand from the developed countries is still not very strong.

Another international problem for the Chinese economy is the drop in foreign direct investment (FDI). Global FDI was at its low point last year at a total of only 1.2 trillion USD (€0.92 trillion), it is expected to improve only slightly this year to 1.3 trillion USD (€1 trillion). One of the major reasons, as Professor Cheng elaborated, was that foreign investors are being pulled back in order to reduce their leverage ratio.

Domestically, China also has its problems. In September 2008, in order to fight the financial crisis, the Chinese government announced a financial stimulus package of 4 trillion RMB (€0.98 trillion) to stimulate the economy, leading to a 9.2% gross rate in 2009. According to Professor Cheng’s research, the gross rate would only have been 2.4% without this investment by the government, which implies that the stimulus package was quite a success. But, as Professor Cheng points out, every policy has both its positive and its negative sides. The negative side of the stimulus package emerged between 2010 and 2012.

To begin with, there was huge excess capacity. Twenty-one out of China’s twenty-four industries suffered from excess capacity. Another problem was the existence of over-inventory. These facts coupled with the decrease in foreign demand led to an accumulation of inventory, something China is still trying to reduce to this very day.

Another negative result of the stimulus package, Professor Cheng points out, was the low investment return. A lot of money went to state-owned enterprises and local government. Many projects were started, some of which were quite inefficient to begin with, providing low returns and others were long-term projects characterised by very small and very slow returns. As a result, efficiency declined. Before the stimulus package, 1 RMB (€0.13) could generate around 0.5 RMB (€0.07) GDP. In 2009, it only generated 0.21 RMB (€0.03). Investment efficiency really went down.

To make matters worse, a lot of environmental problems emerged. According to Professor Cheng’s research, the environmental cost, including low energy efficiency, environmental pollution and the damage of the ecosystem equals 13.5% of China’s GDP in 2005. This year’s prognosis is that China’s GDP will only increase by 10.4 %, which means that the environmental debts are something that are left behind for “our children and grandchildren”.

The oversupply of money by the government also triggered the danger of inflation. It lead to a major increase in inflation rate. In both 2010 and 2011, inflation increased quite a lot. In 2011, China’s inflation rate was at 5.4%. It decreased a little in 2012, but it is still a problem today. In China, local government debt has ballooned, now standing at 10.7 trillion RMB (€1.39 trillion) with around one-third of local governments unable to pay back their debt. Professor Cheng equates and compares this problem of an inability of local government to pay back the money with the sub-prime crisis in the United States.

The financial stimulus package also led to the housing market bubble. In 2009, housing sales in China increased by 42.1%. The stock market, in the first half of 2009, increased abnormally from 1664 Shanghai index points to about 3000. This increase was due to massive investments in the housing market, particularly by state-owned enterprises and local governments that had borrowed money and has since resulted in large unpaid debts.

Change China’s Development Pattern.

Now in 2013, China is dealing with the negative effects of the financial crisis. To tackle these problems, Professor Cheng recommends changing China’s development pattern and he recommends several major changes to achieve this.

China needs to change its reliance on foreign demand to reliance on domestic demand, and should focus especially on domestic consumption. This is not easy, but according to Professor Cheng it can be done by: synchronising the economic growth rate with people’s income; linking salary with the inflation rate; and raising the wages alongside increases in productivity. Over the last two years, the Chinese government has already managed, particularly in the public sector, to link minimum wage in China to the inflation rate. The income floor has been raised several times from 800 (€104) to 1600 (€208) and 2000 (€260) to 3500 RMB (€455), with only 9% of people having to pay income tax in China. But, linking salary with productivity is one problem that has not yet been solved, as Professor Cheng points out. In recent years, salary increases have been higher than increases in productivity.

In order to boost domestic demand, people need an environment in which they feel secure enough to consume. That is why Professor Cheng advocates improvements to China’s social security system. Changes should be made to the pension system, unemployment, medical care and so on.

Feeling safe is not the only condition that needs to be met to stimulate demand. People also need interesting products to buy. Therefore, China needs to trigger and stimulate innovation to provide more products to people. According to Professor Cheng, it is time to change the kinds of products people want to consume. During the time of the Cultural Revolution, there were three major assets to have in any household: a bicycle, a sewing machine, a watch. Then it changed to a colour TV, a washing machine, a refrigerator. Now China needs to provide new types of products for households to aim for, to attract people to consume.

However, this kind of innovation cannot be stimulated by the government alone; therefore, Professor Cheng claims that China needs to develop its venture capital business. In 1998, Professor Cheng already submitted a proposal to the Chinese People’s Political Consultative Conference (CPPCC) to promote venture capital business, which was accepted and named the No 1 proposal of that year. After acceptance, venture capital boomed in China and is just behind the USA as the leading venture capital country today. Venture capital in China stands at 40 billion USD (€30.8bn) and in the United States it stands at 90 billion USD (€69.3bn). But the problem with venture capitalists is the vast majority invest in the later stages as opposed to the early stages of projects––something that is not ideal for stimulating innovation

Solutions to the Problems

The question now remains: how can China’s current economic situation be improved? According to Professor Cheng, several courses of action are needed. Venture capital investment needs to be made more successful. Professor Cheng has always pointed out the important role of venture capital, which is why he initiated the China Venture Capital Forum in 1998. In recent years, he has come up with new ideas to make venture capital business more successful: by promoting entry-investment, by getting investors to invest in the early stages, and by supporting the innovators. Additionally, he puts forward that social venture capital should be promoted by encouraging successful venture capitalists to invest in social businesses. Other ideas include training innovators and scientists to become entrepreneurs, and teaching them how to manage and market their innovative ideas.

Another necessary action proposed by Professor Cheng is to upgrade foreign trade. Even though he argued that China needs to rely more on domestic demand, that does not mean foreign demand should be ignored. He underscores that China should also pay attention to foreign demand and improve foreign trade. China is now second in foreign trade in the world, only a little bit behind the US. With some improvements, Professor Cheng believes that “maybe this year, we can be number one”. But this cannot be achieved without some improvements. China has to promote the increase of independent foreign trade as foreign demand cannot be controlled. Foreign trade should be focused more on Africa, Latin America and South East Asian nations, thereby becoming less reliant on USA, Japan and the EU, especially as protectionism is gaining ground in these countries. Professor Cheng also points out that China needs to choose its foreign investors not only for their money, but for their strategic importance for the Chinese economy: investors that can help improve technology and management, and can help solve environmental problems.

But, promoting venture capital investment and upgrading foreign trading alone is not enough. Professor Cheng argues that Chinese companies also need to implement several internal changes. There has to be a change from extensive growth (increase capacity) to intensive growth (increase productivity). According to Professor Cheng, the industrial productivity (value added per person per year) in China is only one-fifth of the productivity in Germany, which is a problem. Wealth creation is important, too: low productivity and not enough wealth creation can cause significant long-term structural difficulties, e.g. Greece’s debt crisis is attributed to high social expenditure and low productivity. In Professor Cheng’s opinion, it is most important to raise productivity by intensive growth. Only if China can create more wealth, people can receive higher salaries. Intensive growth can be achieved by innovation, by improving management, and also by horizontal and vertical integration of industry.

And finally, which might be one of the most important changes, there should be a change from external momentum (subsidies, investments, bank loans) to internal momentum (people’s activity and creativity). Chinese people work hard; they want to make a better life for themselves. On the one hand, education can raise the level of science, technology, morality and culture; and on the other hand it can foster innovative people. Therefore, the Chinese government should pay more attention to education, as Professor Cheng puts it: “The economy only can guarantee our today; science and technology can guarantee our tomorrow; but only education can guarantee our day after tomorrow; so investing in education is investing in our future”. He added that “only education can make China have a bright future!”

Conclusion

Professor Cheng concluded by reiterating the conclusions he made in his speech at the United Nations in April 2013, entitled China Story: although we have accomplished a lot of notable achievements, we still have a long way to go; although we still have a long way to go, we are on the right track; although we are on the right track, there will be many pitfalls on our way to the future, so we need to always keep a very prudent attitude towards the future, because like the meaning of Professor Cheng’s Chinese name: when you are successful (成), you have to think about threats (思危).

Share on Facebook

Share on Facebook Share on Twitter

Share on Twitter Share on LinkedIn

Share on LinkedIn